We’re living now at the start of a great economic transition, from the fossil fuel economy to the ‘green’ economy. We’re seeing political moves to boost clean energy sources over fossil fuels, as well as to promote cleaner tech, especially vehicles. One immediate result is a wide array of companies, new and old, getting into the electric vehicle (EV) business and its auxiliaries, opening up new opportunities for investors.

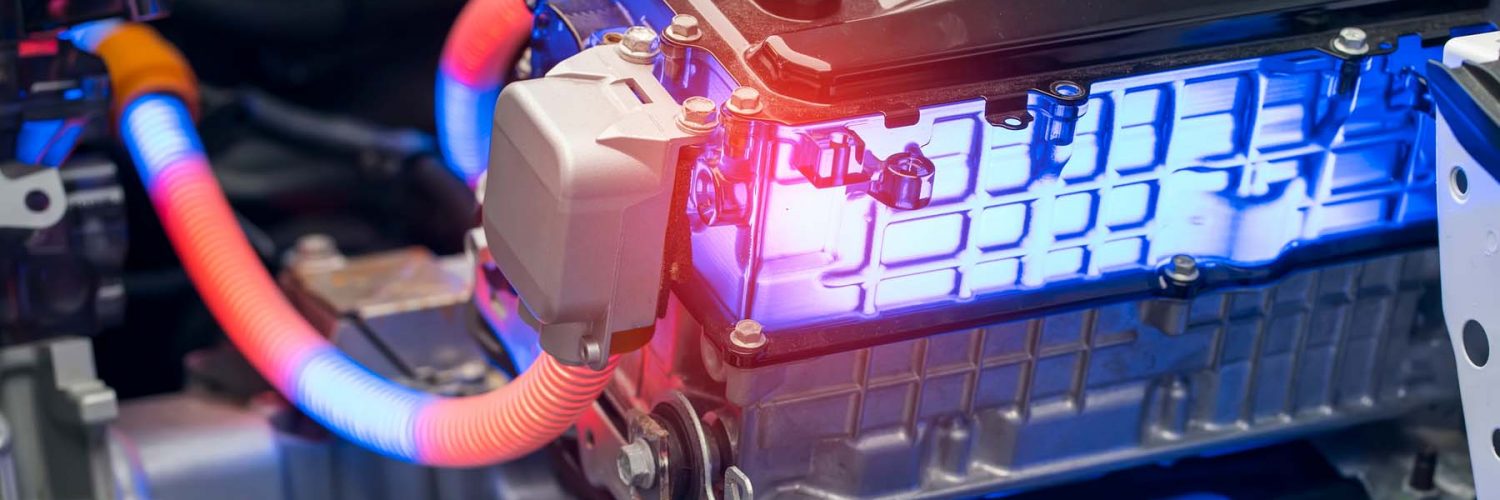

One particularly strong field for such opportunities: supporting infrastructure. Developing new battery technology, recycling old batteries, expanding the EV charging network, exploring and exploiting lithium deposits – these, and more, are all areas that will need solutions as the number of electric cars on the roads continues to grow. And the companies that can successfully build in one of these niches will bring investors the returns they want.

With this in mind, we’ve used TipRanks’ database to look up the latest details on three EV battery stocks. They are producing the raw materials and support structure that EVs require for success. And better yet, Wall Street’s analysts see them as mid- to long-term winners. Let’s take a closer look.

Lithium Americas (LAC)

We’ll start with a mining company. Lithium Americas, a Canadian-based resource company, has two major projects for the production of battery-grade lithium carbonate. This is an essential mineral in the current rechargeable battery production, and Lithium Americas’ projects are expected to produce approximately 100,000 metric tons annually over the next four decades. The mines, Cauchari-Olaroz in northern Argentina and Thacker Pass in Nevada, are gearing up for production in the next 6 to 8 months. Thacker Pass contains the most significant recoverable lithium deposits in the US.

Lithium Americas reported, in its 2Q results, that both projects remain on track. The Cauchari-Olaroz project has 1,200 workers on site, and chemical and processing plants for recovered lithium, which are being built at the mine site, are two-thirds or more complete. This Argentinian lithium project is expected to produced 40,000 tons annually of the company’s total, starting in the middle of next year.

The Thacker Pass mine, in Nevada, is also reported to be meeting the company’s development schedule. The mine, when it begins production later this year, will make lithium a major export from Nevada, which is already known as a mining-intensive state. The Thacker Pass mine is projected to reach some 60,000 tons annually at full output.

Lithium Americas’ mines have not yet entered production, so the company has no revenue stream as yet. This makes the stock highly speculative, but with reason to be bullish: the company’s development is running on time, as is the governmental regulatory process. In addition, the company reported having $505 million in cash on hand and $156 million in undrawn credit at the end of 1H21, available for funding operations.

J.P. Morgan’s Tyler Langton sees potential for Lithium Americas – in fact, the analyst initiated coverage of this stock with an Overweight (i.e. Buy) rating and a price target of $28. This figure implies ~36% one-year upside potential.

Backing his stance, Langton wrote: “Demand for lithium should roughly double from 2021E through 2025E, and then double again from 2025E through 2030E. The biggest driver of this growth should be from electric vehicles (especially battery electric vehicles) continuing to gain share and larger battery sizes… LAC should see strong and steady production growth through the end of the decade, while its two projects should have attractive positions on the cost curve. LAC also has a solid balance sheet to fund this growth and significant leverage to our lithium price forecasts…”

Overall, there are 5 recent analyst reviews on file for Lithium Americas, and they include 4 Buys against a single Hold to give the stock a Strong Buy consensus rating. Shares are selling for $20.60 and the $24.43 average price target suggests the stock has room for ~19% growth in the year ahead.

Albemarle Corporation (ALB)

Next up is Albemarle, a North Carolina-based chemical manufacturer. The company produces lithium and bromine chemical products, as well as catalysts needed in other chemical manufacturing processes. Albemarle has been in business since the 1880s, and has operations across the United States, Chile, and Western Australia, as well as in East Asia, the Middle East, and Europe. The company is the largest global provider of lithium for EV battery backs.

Some recent numbers will show Albemarle’s importance in the global chemical industry. In the last reported quarter, 2Q21, EPS hit $3.62, derived from $424.6 million in net income. This was more than 4x higher than the 80-cent EPS reported in the year ago quarter.

During the second quarter, Albemarle streamlined its operations through the sale of its Fine Chemistry Services division to W.R. Grace & Company. The sale was worth $570 million, of which $300 million was paid in cash and $270 million was issued to Albemarle as preferred equity in a W.R. Grace subsidiary. Albemarle will use the proceeds to execute its long-term growth strategy, which includes a greater focus on lithium operations. The company reported that its lithium performance expanded in the first half of this year.

In September of this year, Albemarle took a major step to increase its lithium production through the acquisition of the Chinese company Guangxi Tianyuan New Energy Materials. Guangxi Tianyuan is a lithium converter company for which Albemarle agreed to pay US$200 million. The deal is expected to close early next year.

Berenberg analyst Sebastian Bray is openly bullish on Albemarle’s prospects, writing of the company: “We expect demand for lithium, the key material used in electric vehicle batteries, to grow strongly during this decade, and pricing to remain firm. We forecast long-term contract prices for Albemarle of USD16,000 per ton, significantly ahead of Albemarle’s 2020 Aaverage contract prices of USD13,000… We expect Albemarle’s earnings to grow strongly on the back of lithium capacity additions. We estimate Albemarle’s production will increase five-fold by 2030E, quickly contracting current valuation multiples.”

In line with these comments, Bray rates ALB shares a Buy, with a $280 price target that indicates a 12-month upside of 30%.

Albemarle also gets decent support from Bray’s colleagues; Based on 10 Buys, 4 Holds and 2 Sells, the stock has a Moderate Buy consensus rating. At $254.38, the average price target suggests upside of ~18% in the year ahead.

ChargePoint Holdings (CHPT)

ChargePoint is one of the largest operators of EV charging station networks in the US and Europe. ChargePoint has more than 5,000 commercial and fleet customers, which include 76% of the Fortune 50 companies. In addition, ChargePoint boasts over 118,000 charging locations in its North American and European networks.

ChargePoint recent reported its Q2 fiscal 2022 results, and showed revenue of $56.1 million, up 61% year-over-year. Of that total revenue, $40.9 million came from networked charging; this was a 91% gain yoy. The company reported more than $618 million in liquid assets.

In a point of interest for investors, ChargePoint raised its full-year guidance range by 15% at the midpoint, to the $225 million to $235 million range.

Earlier this month, ChargePoint announced strategic moves in its European operations, including the acquisition of has·to·be. has·to·be is the provider of be.ENERGISED, a cloud-based e-mobility EV charging software platform. The acquisition will allow ChargePoint to further expand its position in the European EV charging ecosystem, and follows the acquisition of ViriCiti in August.

In coverage for D.A. Davidson, Matt Summerville notes two important factors in CHPT’s prospects: “(1) CHPT has a meaningful first-mover advantage in the North American public L2 EV charging market, with a portfolio of well-regarded products, 100% of which are sold with a CHPT Cloud software subscription (and an approximately 60% of which generate subscriptions from its Assure service/maintenance plan) and can be accessed via CHPT’s highly-downloaded/rated mobile app or via an EV’s infotainment system; (2) a growing presence in the rapidly-expanding European EV charging market, underpinned by its recent acquisitions of has·to·be and ViriCiti…”

To this end, Summerville rates the stock a Buy, and his $30 price target suggests it sill grow 63% over the next year.

Overall, ChargePoint’s 11 recent analyst reviews include 7 Buys, 3 Holds, and 1 Sell, giving the stock its Moderate Buy consensus rating. The average price target of $34 implies a bullish upside of ~85% from the current trading price of $18.40.

This article was originally posted on Yahoo Finance.