You don’t normally think of Federal regulation – or the prospect of Federal regulation – being the catalyst for a sudden, industry-wide, spike in share prices. But that’s exactly what we’re seeing with cannabis stocks right now, as a House Republican has submitted a draft bill on Federal legalization – on that may stand a better chance of passage than Democratic Senator Chuck Schumer’s stalled bill.

The bill is being drafted by South Carolina Republican Nancy Mace, and discussion has been going on since the first week of the month. Her bill contains several key points, including a minimum age of 21 for recreational use of cannabis, and regulation in a manner similar to alcohol. Mace’s bill differs from Senator Schumer’s in one important point, however; where the Senator put in a 25% Federal tax on pot, Mace’s version would only impose a 3.75% excise duty.

That House Republicans are now getting on board the pot legalization bandwagon is a major development. At the same time, investors need to be aware of two cautionary factors: First, there is no guarantee that President Biden will sign such a bill if it reaches his desk. The President is known to be a strong opponent of full cannabis legalization, although he has indicated that he would permit decriminalization or medical use measures. And second, there are only a few weeks left in the current legislative session. Given this Congress’ poor record of pushing ‘big deal’ bills through, there is no guarantee that this measure will pass.

Bearing that in mind, there are plenty of options for those willing to shoulder the risk. We used TipRanks’ database to take a closer look at three cannabis stocks backed by Wall Street analysts. Not only all of the names have received enough support to earn a “Strong Buy” consensus rating, but each also boasts some brag-worthy upside potential. Here are the details.

Verano Holdings (VRNOF)

First up on the list is Verano Holdings, a $1.69 billion company based in Chicago. The company is a major producer in the US cannabis market. The company has 11 cultivation and production facilities, providing cannabis products for 87 operating retail locations. Verano sells its cannabis products subject to state regulations under four brand names. Its production facilities boast over 830,000 square feet of growing space.

Verano has been working steadily to expand its footprint, and in October and November it opened two new dispensaries – featuring its Zen Leaf brand – in St. Charles, Illinois and in Las Vegas, Nevada. In addition, the company announced on November 10 that it will be entering the Connecticut cannabis market.

The company will report 3Q21 earnings on November 16, but a look back at Q2 can give us a sense of where Verano stands. Revenues reached $199 million in that quarter, up 39% sequentially and a whopping 164% year-over-year. The quarter was a company record. After the second quarter ended, the company announced an upsize to its existing credit facility, boosting the total available to $250 million. The interest rate is 8.5%, and the agreement includes an additional $100 million on option. The upsized credit is a major increase in Verano’s available liquidity.

Analyst Scott Fortune, from Roth Capital, sees Verano as a compelling buy, especially after the stock’s share price has fallen over the past several months.

“We believe VRNO is overdue for a significant rerating after the share lockup overhang and improved share liquidity similar to the top MSOs… With shares trading [~46%] off its 52-week high, VRNO presents a compelling valuation opportunity at these levels and remains our favorite MSO name with the largest potential appreciation upside from strong fundamentals and ahead of potential incremental federal legislation,” Fortune noted.

To this the Roth Capital analyst gives the stock a Buy rating, and his $32 price target implies a one-year upside of ~131%.

Overall, Verano’s Strong Buy consensus rating reflects a unanimous approval from Wall Street, with recent 4 positive reviews. The shares are priced at $13.86 and the $32.10 average price target matches Roth Capital’s.

Green Thumb (GTBIF)

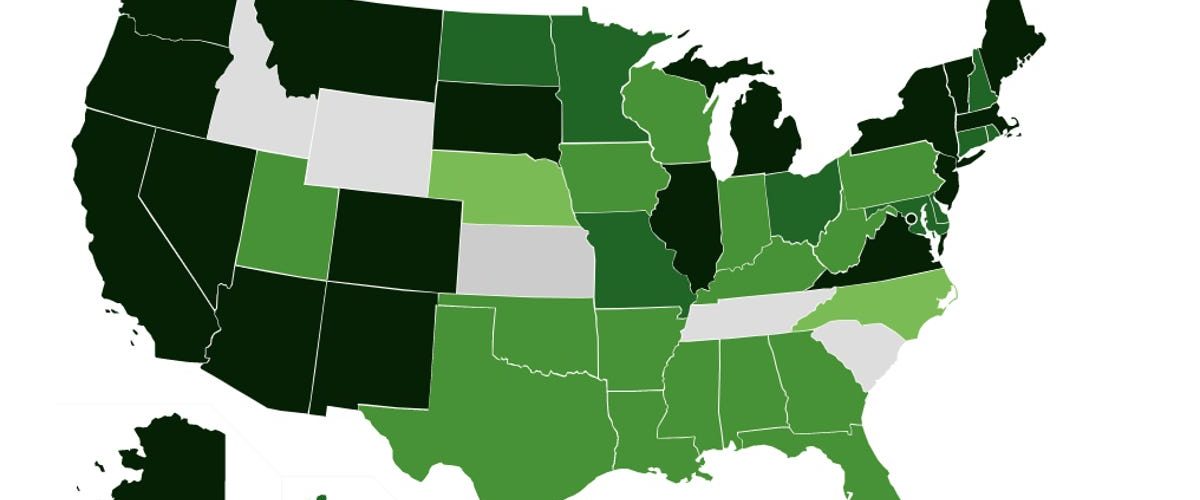

The next cannabis stock we’re looking at, Green Thumb, focuses on the medical and consumer aspects of the cannabis market and has a network that spans 14 US jurisdictions. The company boasts 16 manufacturing facilities feeding product to 66 open retail stores, which sell a half-dozen branded cannabis and cannabis product lines. The company’s recreational products include pre-rolled cannabis cigarettes, vapes, edibles, and even ‘social dosing’ cakes, designed for smoking in groups.

Green Thumb has been opening a chain of retail locations under its house brand, Rise, in recent months. The company’s 65th store was opened in Bloomfield, NJ, in September, while the 66th location opened its doors in Mundelein, Illinois, in October. The Mundelein location will include a ‘roll through’ pick-up window for medical cannabis patients.

In the third quarter, Green Thumb reported $233.7 million in revenue, up 5.3% from Q2 and 48.7% yoy. Significantly, it was the 5th quarter in a row of positive earnings, showing an EPS profit of 8 cents per share, and the 7th consecutive quarter of positive cash flow, $82.8 million in cash from operations. Green Thumb finished Q3 with $285.8 million in cash on hand.

In coverage for investment firm Needham, analyst Matt McGinley sees Green Thumb in a solid position to continue its growth.

“We see substantially less risk to margin and revenue estimates at GTI given M&A integration and improvement in operating efficiency isn’t really a theme for GTI into ’22 in the way that it is for most of its peers. We believe that GTI has the right strategic vision and record of strong execution to keep it on a path for continued profitable growth. At an EV/EBITDA multiple of 12.8x our ’22 estimate, we believe the stock is cheap for a company with such consistency and opportunity for long-run growth,” McGinley opined.

McGinley’s Buy rating on the stock backs up his $36 price target; he sees an upside here of ~33% for the coming year.

Some stocks make a roundly positive impression on Wall Street’s analysts, and Green Thumb is one of those. This cannabis company has a unanimous Strong Buy consensus rating, based on 4 recent positive reviews. The shares are priced at $27.11 and the average price target is even more bullish than McGinley would allow. At $46.14, it suggests that Green Thumb shares can appreciate ~70% in the coming 12 months.

Cresco Labs (CRLBF)

Last but not least is Cresco Labs. This company – also based in Chicago – focuses on the medical marijuana segment. The company has 9 branded product lines, operates in 10 states, boasts 20 production facilities, and owns 40 dispensaries. Along with that, Cresco has 47 retail licenses. All of this represents approximately 35% company growth – in its production and retail footprint – this year.

Cresco’s branded products include medicinal extracts, edibles, bulk leaf for smoking, and more. The company’s 40th location, a Sunnyside retail shop, opened in Oakland Park, Florida, in October. The opening marks the company’s 11th Florida location, part of an expanding footprint in the country’s third-most populous state.

In its recent 3Q21 financial report, Cresco showed some important results. Revenues were up substantially year-over-year, growing by 40.6% to reach $215.5 million. This included record net wholesale revenue of $109.3 million, and record retail revenue of $106.2 million. The company had total assets of $449 million at the end of Q3; included in that were cash and liquid assets of $252.8 million. This was balanced by Senior Loan debt of $376.6 million.

Among the bulls is BTIG analyst Camilo Lyon, who rates Cresco Labs shares a Buy, along with a C$23 (US$18.32) price target. At current levels, this target suggests ~90% upside for the year ahead.

In his coverage of this stock, Lyon writes: “We see CL benefiting from the combination of robust industry tailwinds bolstered by prudent yet strategic steps to deepen its presence in key states while expanding its house of brands through growing wholesale distribution resulting in robust revenue growth of ~65% and 30%+ adj. EBITDA margins. Lastly, with a shored-up balance sheet and ~$256M in cash and debt/ adj. EBITDA ratio of ~1.8x (which we estimate falls below 1x this year), we believe CL is primed to continue on its accelerated growth path.”

All in all, Cresco has picked up 8 Wall Street analyst reviews recently, and they break down 7 to 1 in favor of Buys over Hold. The stock’s average price target of $16.90 implies a one-year upside of 74% from the current share price of $9.66. As a result, the word on the Street is that Cresco is a ‘Strong Buy.’

Source: Yahoo Finance