U.S. stock futures pointed to losses at Tuesday’s open as investors mulled disappointing earnings from Walmart and General Motors and braced for results from Big Tech.

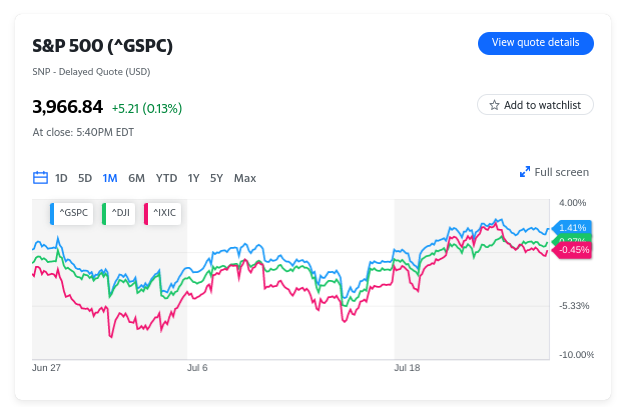

Futures tied to the benchmark S&P 500 edged down 0.5%, while futures on the Dow Jones Industrial Average declined by roughly the same margin, or 155 points. Contracts on the technology-heavy Nasdaq Composite fell 0.6%.

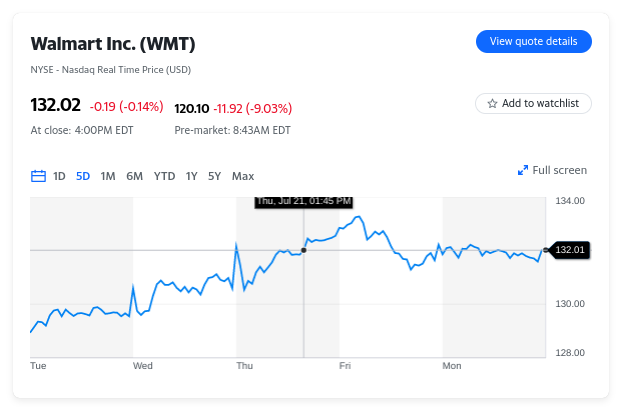

Shares of Walmart (WMT) plunged 9% in pre-market trading after the retail giant slashed its second quarter and full-year profit outlooks late Monday due to rampant inflation and a resulting pullback in consumer spending on discretionary items.

“The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars,” Walmart CEO Doug McMillon in a statement. “We’re now anticipating more pressure on general merchandise in the back half; however, we’re encouraged by the start we’re seeing on school supplies in Walmart U.S.”

Walmart’s warning sent shares of other retailers lower in the early trade. Amazon (AMZN) stock fell 3.5%, Target (TGT) declined 5%, and Dollar General (DG) slipped 3%.

Also weighing on sentiment was a disappointing report from General Motors (GM) early Tuesday that showed second-quarter results fell short of Wall Street estimates. The Detroit-based automaker saw its net income fall 40% from a year ago during the period and said it failed to deliver 95,000 vehicles due to part shortages. Shares fell nearly 2% in the early trade.

Elsewhere in markets, shares of UBS (UBS) dropped more than 7% after the Swiss bank reported a smaller quarterly profit than analyst anticipated as market volatility weighed on investment banking revenues and the financial institution warned of a challenging second half of the year.

Federal Reserve officials will convene for their two-day policy meeting Tuesday and are expected to raise interest rates another 75 basis points at its conclusion Wednesday afternoon. Federal Reserve Chair Jerome Powell is set to deliver remarks at 2:30 p.m. ET shortly after the U.S. central bank’s policy decision comes out at 2:00 p.m. ET.

Investors are in the throes of the busiest week of the year for Wall Street, with Big Tech earnings on tap, a busy calendar of economic releases – including the all-important advance estimate of second-quarter GDP – and the Fed’s rate decision in the spotlight.

Second quarter reports from Microsoft (MSFT) and Alphabet (GOOG) will be closely-watched after the bell.

According to FactSet Research, 21% of companies in the S&P 500 have reported second-quarter earnings through Friday, with only 68% presenting actual earnings per share above estimates — below the five-year average of 77%. Any earnings beats have also, in aggregate, been only 3.6% above estimates, less than half of the five-year average of 8.8%.

Source: Yahoo Finance