U.S. index futures advanced and global stocks rebounded from a two-month low as a debt-ceiling deal in Washington and central-bank assurances about transitory inflation boosted optimism the economic recovery can continue.

December contracts the S&P 500 Index rose 0.6% as dip buyers returned to the equity markets after Tuesday’s worst selloff since May 12. The dollar fell from the highest level in almost 11 months. Treasury yields were steady. Asian stocks erased losses amid gains in China before a weeklong holiday.

An agreement among U.S. lawmakers to extend government funding removes one uncertainty from a litany of risks investors are contenting with, ranging from China’s growth slowdown to Federal Reserve tapering. Fed Chair Jerome Powell and his European counterpart Christine Lagarde have reiterated their view inflation is transitory, seeking to allay a key concern that’s boosted bond yields and depressed equity valuations.

“Republicans and Democrats showed some compromise by averting a government shutdown,” Sebastien Galy, a senior macro strategist at Nordea Investment Funds. “By removing what felt like a significant risk for a retail audience, it helps sentiment in the equity market.”

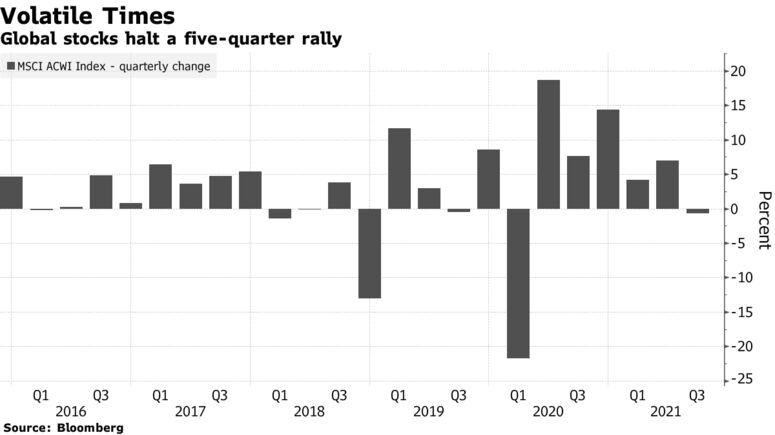

Global stocks are poised to end the quarter with a small loss, after a five-quarter rally, as investors brace for the Fed to wind down its stimulus. They also remain concerned about slowing growth and elevated inflation, supply-chain bottlenecks, an energy crunch and regulatory risks emanating from China. A majority of participants in a Citigroup Inc. survey said a 20% pullback in stocks is more likely than a 20% rally.

At the same time, some investors believe equities can grind higher, albeit amid volatility, as they see inflationary risks as temporary and bet on post-pandemic growth. They’re buying stocks after every meaningful drop.

Such dip-buying continued on Thursday. In Europe, the Stoxx 600 equities gauge trimmed a monthly loss. Miners paced the gains as iron ore climbed. Technology stocks, battered earlier this week, also extended their rebound.

Oil climbed after a two-day slump, heading for a monthly gain amid tighter supplies. West Texas Intermediate futures recaptured the level above $75 per barrel.

Senate Majority Leader Chuck Schumer said Wednesday lawmakers had reached an agreement to avoid a government shutdown on Friday, extending government spending until Dec. 3. Earlier, Powell and his counterparts in Japan, Europe and the U.K. voiced cautious optimism that supply-chain disruptions lifting inflation rates around the world would ultimately prove temporary.

Asian stocks erased losses on a volatile day as investors weighed further evidence of a slowdown in China. Factory activity in the world’s second-largest economy contracted in September for the first time in the pandemic era.

Here are some events to watch this week:

- House Financial Services Committee hearing on the Fed, Treasury’s pandemic response, Thursday

- Univ. of Michigan sentiment, ISM manufacturing, U.S. construction spending, spending/personal income, Friday

Source: Bloomberg