The world is facing a shortage of semiconductors due to terrific demand, which has exploded across multiple verticals such as smartphones, gaming consoles, personal computers, and automotive production. As a result, semiconductor foundries have accelerated their investments in chipmaking equipment, triggering impressive growth for ASML Holding (NASDAQ: ASML), which supplies such equipment.

ASML Holding is an expensive stock with a price-to-earnings ratio of 63, and investors should be ready to pounce on any opportunity to buy it on the cheap. This is a high-growth company on track to sustain its sales momentum thanks to a massive end-market opportunity that lies ahead.

It recorded 4 billion euros ($4.7 billion) in revenue in the second quarter of 2021, a 21% increase over the prior-year period. The company’s diluted net income jumped from 1.79 euros per share in the prior-year period to 2.52 euros per share last quarter. What’s more, ASML increased its full-year forecast and now expects 35% revenue growth in 2021, up from its earlier expectation for 30% growth.

Analysts predict ASML will clock annual earnings growth of nearly 30% for the next five years, which isn’t surprising given the explosive increase in demand for its photolithography machines used in chip production. The global photolithography equipment market is expected to hit $29 billion in revenue by 2026.

ASML reportedly commands 62% of this market, while it has a monopolistic position in extreme ultraviolet (EUV) lithography systems. It is worth noting that the EUV lithography market is expected to generate more than $13 billion in revenue by 2024 compared to $2.16 billion in 2018. All of this indicates that ASML is built for long-term growth, making it an ideal buy-on-the-dip candidate amid the September sell-off.

Take advantage of hot tech trends with these semiconductor plays

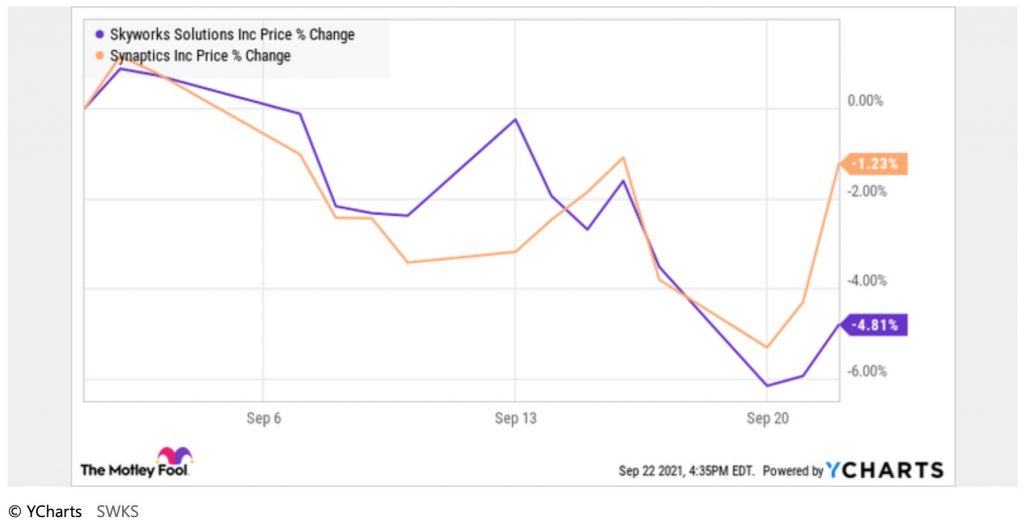

A few other semiconductor stocks that have witnessed explosive demand for their chips have dropped in recent months. Synaptics (NASDAQ: SYNA) and Skyworks Solutions (NASDAQ: SWKS) are two such stocks that have pulled back in the mid single digits in September.

A Synaptics pullback would give investors the chance to buy a rapidly growing company at a lower valuation. The stock trades around 86 times trailing earnings now as compared to a trailing P/E of over 90 earlier this month. It makes sense to take advantage of a dip in Synaptics stock, as the business has switched into a higher gear.

The company, which supplies chips for the Internet of Things (IoT), personal computers, and smartphones, recorded 18% year-over-year revenue growth in the fourth quarter of fiscal 2021 to $328 million. Synaptics expects adjusted earnings of $2.60 per share this quarter, a 40% increase over the year-ago period. For the full year, the company is expected to record 22% earnings growth as per analysts’ estimates, and it won’t be surprising to see it maintain that momentum over the long run because of the explosive growth it is witnessing in the IoT market.

IoT accounts for half of Synaptics’ revenue, and the segment’s revenue had increased 143% year over year in the previous quarter. For fiscal 2021, Synaptics had recorded 83% growth in IoT revenue to $581 million, and it expects the fast pace of the segment’s increases to continue. It sees revenue from home automation, surveillance, video doorbells, wearables, and fitness-related applications doubling over the next 18 months, while the demand for its Wi-Fi and Bluetooth combo chipsets is also booming.

Skyworks Solutions, on the other hand, looks like a steal right now with the stock trading at 20 times trailing earnings. The chipmaker’s revenue shot up 52% year over year in the third quarter of fiscal 2021, while adjusted earnings jumped 72% year over year to $2.15 per share. The company is now set to step on the gas with the launch of Apple‘s (NASDAQ: AAPL) iPhone 13 since the smartphone giant accounts for 56% of total revenue.

Apple has equipped the latest iPhone with more 5G wireless bands, which should lead to stronger demand for Skyworks’ radio frequency (RF) filters that are used in iPhones. Not surprisingly, Skyworks is anticipating a 36% year-over-year revenue increase in the current quarter to $1.3 billion, a trend that’s likely to continue as Apple’s sales are expected to take off.

Credit Suisse estimates that Apple’s iPhone sales could jump to 237 million units in 2022 from 234 million this year, and 249 million units in 2023. So, Skyworks seems set for long-term growth thanks to the bright prospects of its biggest customer, making it a top 5G stock to buy during a sell-off.

More growth stocks trading at relatively cheaper levels

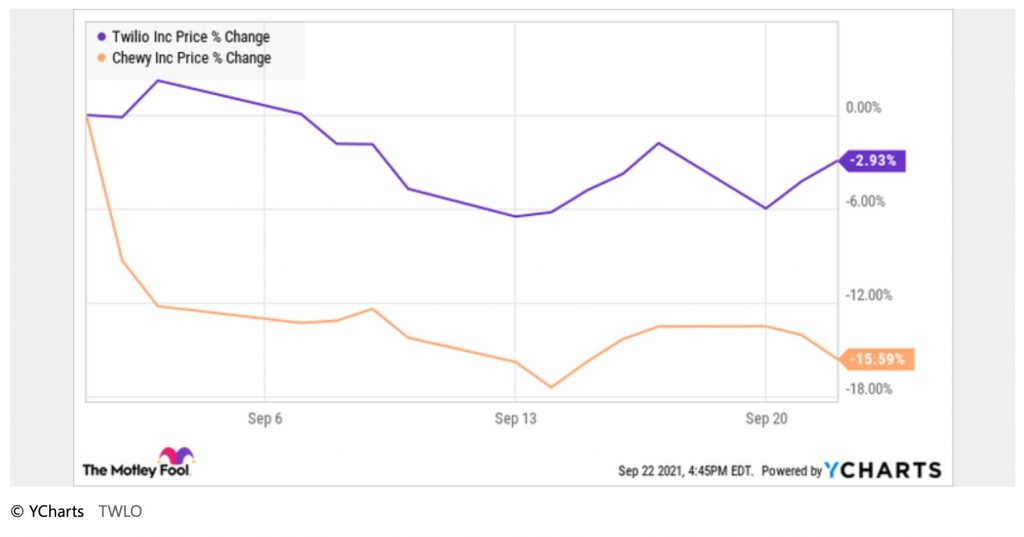

Twilio (NYSE: TWLO) and Chewy (NYSE: CHWY) are two more high-growth companies that have taken a beating this month.

A $1,000 investment in Twilio five years ago is worth $22,000 now. Past performance isn’t always indicative of future results, but I still think it would be a good idea to buy this stock on the dip, as it has the potential to become a multibagger once again. The cloud communications specialist is rapidly adding new customers and is driving higher spending from its customer base.

The cloud communications space is increasing at a compound annual growth rate of nearly 28% a year, according to Mordor Intelligence. And Twilio is growing faster than the industry it operates in, with second-quarter revenue jumping 67% year over year to $669 million. Investors can expect this to continue as the company is sitting on an addressable revenue opportunity worth $87 billion, which is way bigger than the company’s trailing-12-month revenue of $2.25 billion.

Twilio is trading at 24.6 times sales versus last year’s average of over 31, and the dip gives investors the chance to buy this cloud stock at a relatively attractive valuation.

Chewy, on the other hand, has tumbled substantially in September, as the chart above shows. That has brought the stock’s price-to-sales ratio down to 3.9 from 5.6 last year. But there has been no letup in the online pet products retailer’s growth, with second-quarter revenue increasing 27% year over year to $2.16 billion. The company’s customer count ballooned to more than 20 million last quarter, a 21% increase over the prior year.

Customer spending also increased with net sales per active customer 13.5% higher over last year at $404. These impressive growth trends seem to be here to stay as spending on pets in the U.S. could hit $275 billion by 2030 as compared to $118 billion in 2019, according to Morgan Stanley. Chewy is in position to take advantage, with a 41% share of the online pet products market. What’s more, the e-commerce channel is expected to account for 53% of the online pet products market by 2025, indicating that Chewy is sitting on a massive opportunity.

All of this makes Chewy one of the many growth stocks trading at an attractive valuation right now after the September sell-off. As such, savvy investors would do well to scour the stock market for more opportunities arising out of a stock market correction and set up their portfolios for long-term gains.

Source: MSN Money